Next-Generation AI-Driven Automotive Pricing

An AI-powered platform that learns from millions of listings daily, providing unmatched, real-time valuation intelligence.

Automotive market demands dynamic, data-driven insights.

If you have ever complained about car prices not being estimated properly, those days are over. Check out the most advanced car price evaluation service in Europe.

Unveil the value: a detailed price breakdown

Get a complete picture of your car’s market position by comparing recommended pricing to real sales and current listings. We factor in details like mileage and equipment, ensuring you always have an accurate, competitively positioned price.

See how your vehicle measures up

Compare your car’s equipment level to similar vehicles on the market. Identify which features set you apart—and where you might be missing out. With the right combination of options, you’ll attract more buyers and command a stronger selling price.

Trend in the average price over the past six months

This chart highlights the gap between average advertised prices and actual sale prices over the past six months. Understanding these trends helps you set a competitive price and maximize returns.

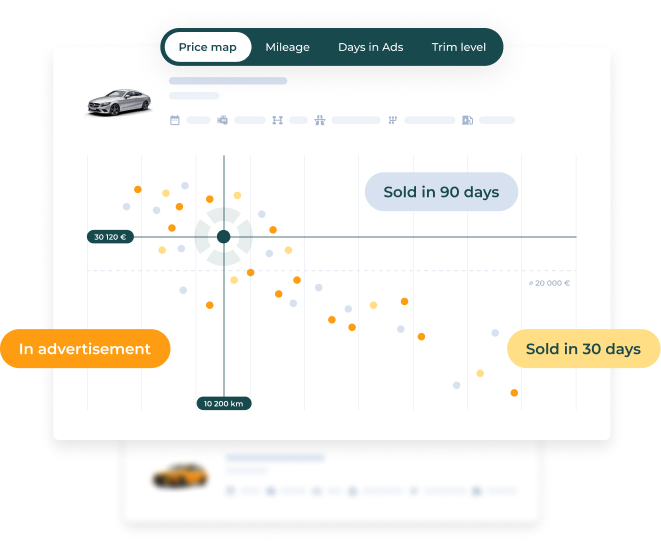

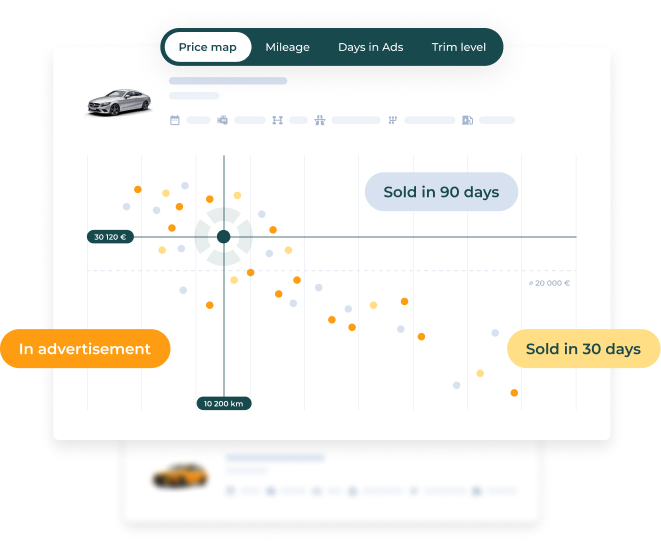

Pinpoint Your Position in the Market

Delve into interactive charts that reveal your vehicle’s true position among similar listings. This data-driven perspective highlights price disparities, days on market, and competitor attributes, enabling an informed strategy to attract buyers and accelerate turnover.

All the perspectives you might ever need

Compare multiple listings simultaneously—complete with price, days on market, mileage, and key features. Pinpoint differences in real time, see where you’re missing critical information, and apply data-driven adjustments so your vehicles stay ahead of the competition.

Price Report automatically filters out fake or misleading ads, ensuring that you only compare reliable, up-to-date data. With cleaner inputs, you can trust every pricing recommendation and avoid basing decisions on inaccurate listings.

Dive into each car’s specific trim level, added extras, and VIN-verified equipment. By matching vehicles on every relevant detail, you’ll create more accurate comparisons and position your inventory for maximum appeal and profitability.

Uncover exactly how mileage variations influence a vehicle’s market value. Determine whether your listing is over or under the typical range—and adjust pricing or emphasize standout features to justify your chosen price point.

You might be wondering

Correct Price Report is absolutely crucial for car dealers and can help bring significant increases in profit margins, sometimes by as much as tens of percentage points. We use the data from car advertisements and auctions across Europe and the latest technology to price cars. First, we consolidate the information, identify an exact specification of the vehicle model(s), and remove duplicates and incorrect/meaningless adverts, so that we have a clear picture of how many cars are actually on the market. For us, it’s all about the best quality data, as the accuracy of the estimated selling prices and liquidity (estimated selling time) of the cars all hinges on it.

Second, we focus on identifying deceptive market practices that distort market information. Specific examples of these are “cars just sold” - attractive cars that don’t actually exist, as well as fraudulent advertisements (scams), identifying cars with the odometer turned back, cars with undeclared damage, etc. We can also reliably identify the less harmful, but still frequent, practice, of renewed advertisements, where the advertisement pretends to be a new car. Systems that don't have these skills naturally tend to estimate unrealistic/faster sale times and drive actual prices down. This is because they can’t recognize which car price is not real. We process approximately 7 million ads a day in this way.

The third step involves using advanced technology to determine the real market price of each car as accurately as possible. Making great use of machine learning and artificial intelligence, we determine the specific attractiveness of a car for each country. We take into account the number of accessories, together with the impact specific features have on demand and price, as well as missing features which in turn reduce the price of the car or impair its marketability. Thanks to a wealth of data from all over Europe, we can even price the cars that sell poorly in your area. This is even down to the level of similar cars, not just the same specification, including equipment and mileage.

We focus on getting rid of the shortcomings that other services have known about for years.

- Non-existent, attractive cars that only attract customers to the dealer, but, in reality, these cars don't exist and apparently lower the market price

- Renewed advertisements, where it appears that more cars have been sold, faster, and at a higher price than is actually the case

- Fraudulently attractive adverts, which are only used to extract money from customers

- Deliberate misrepresentation of tax-free prices or prices that only offer financing, without recognizing damage to cars or turned-back mileage that has already appeared on the market

- Generally outdated valuation methods which don’t take into account the current market situation (e.g., price drops when new models are launched or situations like Covid-19)

- The wrong method of including the equipment into the price and whether a particular missing feature in turn reduces the marketability of the car and thus its price

All of this is a matter of course for us and we’re continually investing in further improvements.

To enable us to determine the selling price, we monitor the entire retail market. We consider a sold car to be one that disappears from a listing and does not reappear within a certain period of time, or when the same car does not appear in another listing. Of course, there is a relatively small percentage of cars that, in the end, aren’t sold, and this primarily concerns private individuals who change their minds for some reason. Even this information carries weight in our valuation. We then take the last price quoted in the advertisement as the sale price. It is possible that the car may have actually been sold at a discount, but this is an area that cannot be further specified for several reasons - often a discount is given by the dealer in a form other than cash (for example, a set of free tyres), the car is financed and sold at a lower price with the proceeds of financing, or the price is reduced by a setoff for a trade-in.

Try now. Price a car.